Introduction

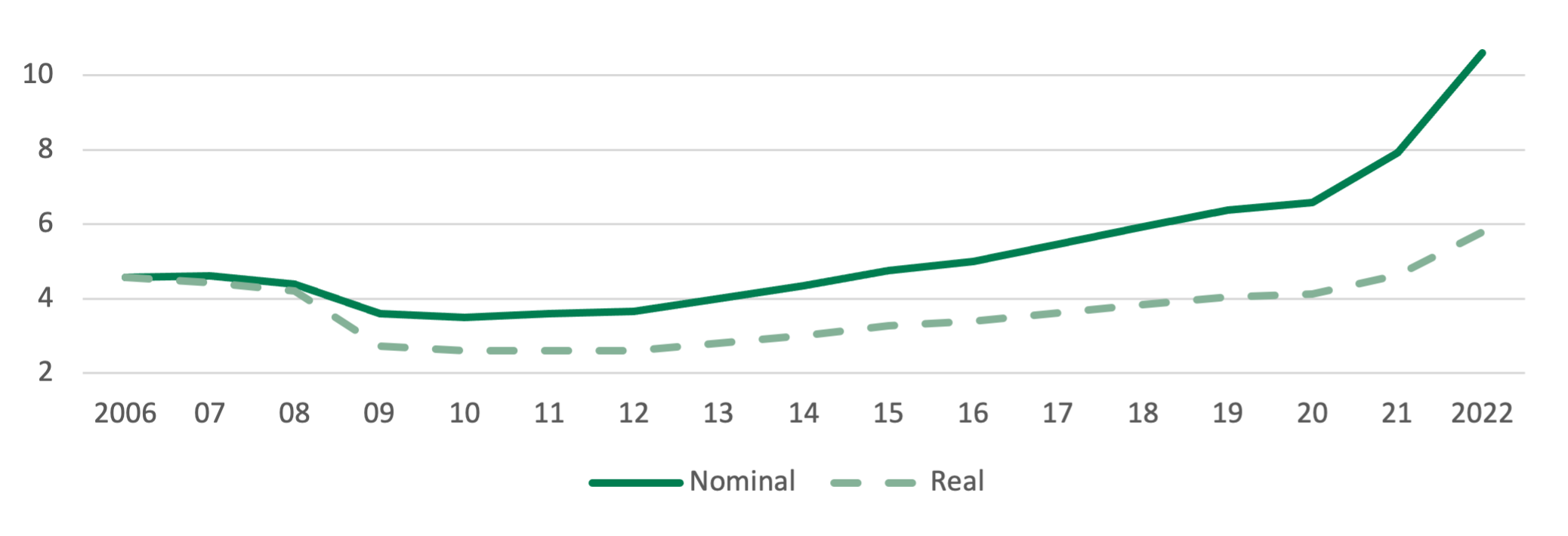

2022 was a year of record global rent growth in nominal and real terms, since Prologis Research began tracking in 2007. Global rents grew by 30% year-over-year (real growth 21%), accelerating significantly beyond the prior record of 17% (10% real in 2021).i The restructuring of global supply chains for added resilience, in conjunction with the build-out of e-fulfillment capabilities produced strong demand for space. Competition for space in 2022 continued to be intense as increased land scarcity, rising regulatory barriers and escalating construction costs slowed new supply in prime locations.

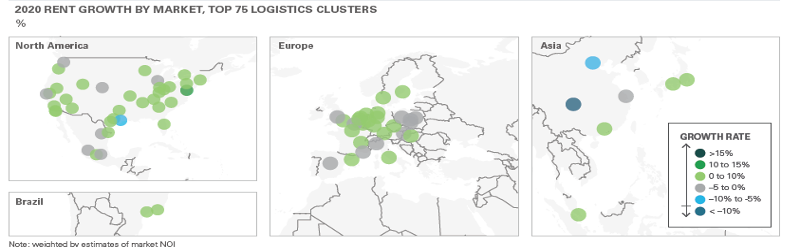

The Prologis Logistics Rent Index combines our expert local market insights and proprietary data to examine net effective rental growthi trends across markets in North America, Europe, Asia and Latin America. Rental rates at the regional and global levels are weighted averages based on estimates of market revenue (market stock multiplied by market rental rate).

FY22 RENT GROWTH, GOBAL, US/CANADA, EUROPE i

- Global: 30%

- U.S./Canada: 34%

- Europe: 15%

EXHIBIT 1 - RENT GROWTH BY MARKET, TOP 75 LOGISTICS CLUSTERS GLOBALLY i – MAP

EXHIBIT 2 - LOGISTICS SPACE VACANCY ii

- US: 3.2%, -20bps year-over-year

- EU: 2.7%, flat year-over-year

EXHIBIT 3 - TOP 10 GLOBAL RENT GROWTH MARKETS i

- Los Angeles

- Inland Empire

- Toronto

- South Florida

- Phoenix

- Baltimore-Washington DC

- Prague

- Las Vegas

- Reno

- Columbus

Takeaways

- The U.S. led a widespread acceleration in rent growth. Competition for space increased as vacancies dropped, which was most evident in the U.S. where customers made rapid changes in real estate strategies in response to supply chain disruption.

- De-risking of the global value chain drives structural demand. Properties located near the end consumer and with access to high-quality infrastructure were in highest demand and should continue to outperform.

- Customers want space in locations where it’s nearly impossible to build. Construction activity is up but inconsistent across geographies as regulatory barriers increase and land becomes increasingly scarce.

- Surging construction costs drove rents higher. Rapidly increasing construction costs (and, more recently, cap rate expansion) create higher rents to support the cost and risk of development.

Global Trends and Outlook

De-risking of the global value chain

Companies continue to prioritize resilience over lean inventory levels, leading to a significant shift in real estate strategies. The need for more space drove increased competition in prime locations with low vacancies. The combination of robust demand and limited new supply led to further drops in vacancies in the U.S. (3.2%), whilst Europe retained the previous years’ record low levels (2.7%) in 2022.ii Structural demand factors—including the build-out of e-fulfillment capabilities, nearshoring, and inventory growth for resilience and greater product variety—will drive expansion in 2023 through the economic cycle.

Regulatory barriers to supply

Rent growth was strongest in prime consumer-end markets where land scarcity was greatest and regulatory barriers presented the biggest challenge to new supply. Increasingly, stringent regulatory barriers are limiting space expansion and increasing entitlement timelines, which doubled in many markets during the last three years. In California, Oregon and New York, several municipalities are enacting moratoriums on industrial developments. Similarly, restrictive measures are considered in France, the Netherlands and Germany. Meanwhile, under-construction volumes rose as developers turned to alternative locations with fewer restrictions to meet demand. To illustrate, despite rising demand for space and rent growth in urban locations, the share of total European development in urban markets dropped from 28% to 19% from 2017 to 2022 iii As a result, companies need to make swift decisions to secure much-needed space in prime locations, which are expected to remain structurally undersupplied going forward.

Construction costs

Building costs rose as materials ran short and supply chains were disrupted by COVID-19, the war in Ukraine, labor turmoil and rapid inflation. As a result, material costs rose 39% in the U.S./Canada and 35% in Europe in 24 months (October 2020-2022).iv Rising construction costs, in combination with land acquired at peak pricing, caused developers to increase rents to support new development. Growing replacement costs underscored rent growth across markets, but the relationship was strongest in land-rich locations where new supply can rise quickly to meet demand and trader-developers build at low margins, such as Poland. Supply chain pressures are starting to ease, which is reflected in material costs stabilizing in some markets and falling in others. The expected declines in material costs and land values in 2023 are offset with yield expansion, requiring higher rents to justify the risk of development.

EXHIBIT 4 - CONSTRUCTION COST COMMODITIES BASKET iv

![2.png CONSTRUCTION COST COMMODITIES BASKET]](/sites/sweden/files/images/2023/02/2.png)

Outlook

Location is key as transportation costs fluctuate substantially and consumer service level demands remain high. As a result, markets with high-quality infrastructure close to the end consumer are likely to outperform. After 2022’s record rent growth of 30%,i we expect to see normalization in the pace of rent growth driven by a slower pace of deal-making (as economic growth and urgency cools) and increased supply in some markets. Structural forces, including e-commerce growth and supply chain reconfiguration, are likely to drive expansion through the cycle. Regulatory barriers, land scarcity and rising capital costs, however, will continue to limit new supply and, in the most constrained markets, leasing conditions are unlikely to ease.

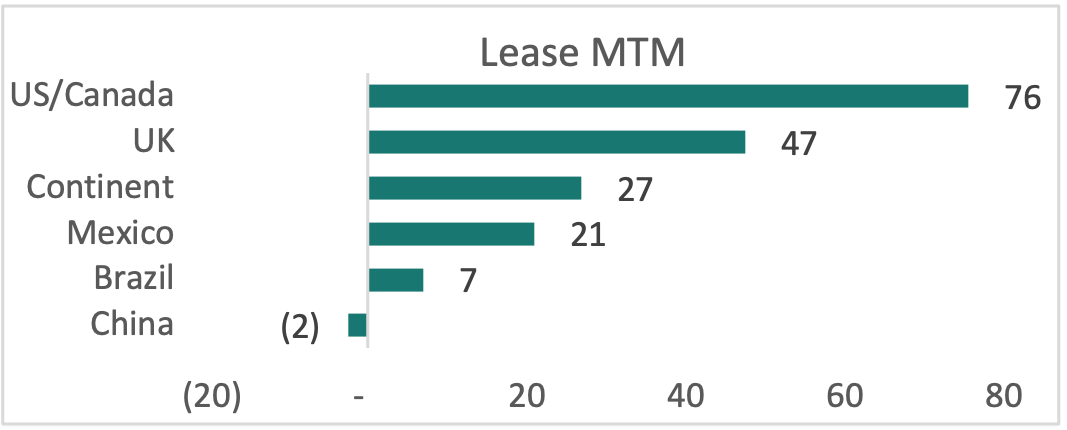

EXHIBIT 5 – Lease MARK TO MARKET EXHIBIT

Regional Highlights

Rent growth in the U.S./Canada accelerated to an all-time high of 34% year-over-year.i With vacancy rates at record-low levels in most locations and widespread demand, rent growth was strong across many markets. The vacancy rate hovered in the low 3% range through 2022.ii Our customers reported both strong activity and high utilization of space throughout the year. The IBI, our proprietary survey of customer sentiment, showed activity at a healthy 60 and utilization rate a high 86% at year-end,iii indicating minimal shadow space and a continued need for warehouse space to accommodate future growth.

The pace of decision-making is normalizing and, with growing economic uncertainty, not likely to reaccelerate next year. At the same time, users will have more options due to the record pipeline of 545 MSF across Prologis’ 31 markets. Against that backdrop, while rent growth will likely slow from its recent robust pace, it should maintain a healthy rate above inflation.

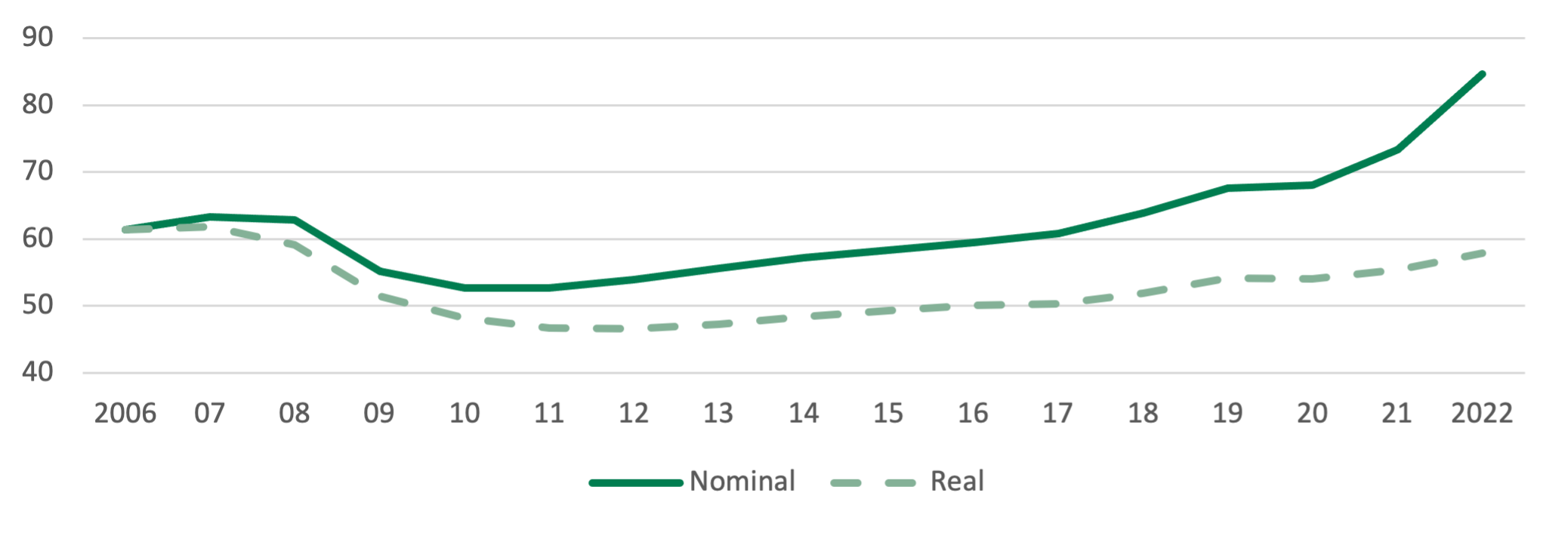

EXHIBIT 6 - EFFECTIVE MARKET RATE, U.S./CANADA i

EXHIBIT 7 - TOP 10 RENT GROWTH MARKETS, U.S./CANADA iii

- Los Angeles

- Inland Empire

- Toronto

- South Florida

- Phoenix

- Baltimore-Washington DC

- Las Vegas

- Reno

- Columbus

- Indianapolis

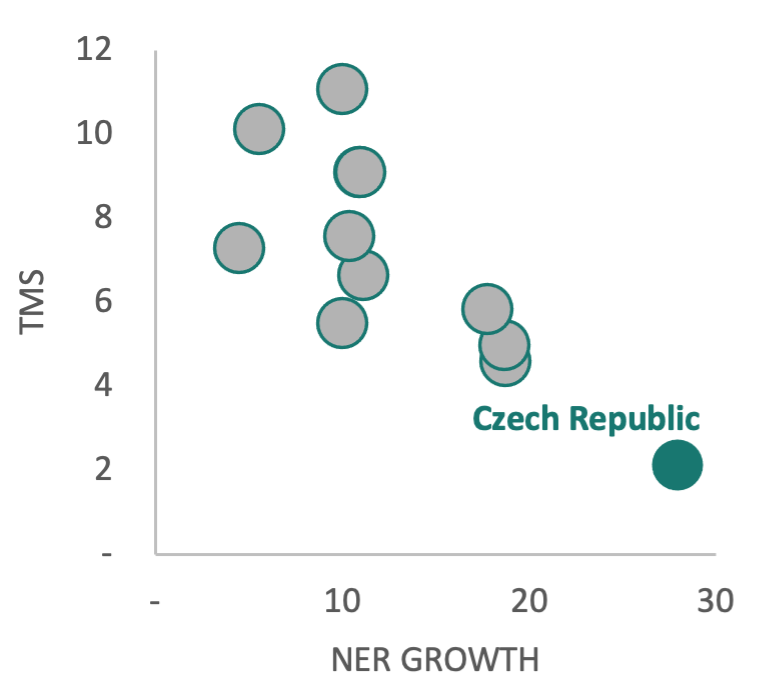

Rents grew at a record pace in Europe in 2022, rising 15% year-over-year.i 2022 year-end vacancy was near the record low at 2.7%,ii leading to an acceleration of rents across markets. We see a clear relationship between true months of supply (TMS)/supply risk and rental growth as the growth trajectory was steepest in those locations with the lowest vacancy and highest barriers to supply, e.g., Prague (0%).ii Significant increases in replacement cost (accelerated by the war in Ukraine) pushed rents upward, even in more land-rich locations. Take Poland, for example, where rents increased more than 20%, a market that has lagged in the past.

Development slowed in 2022, and lower completions are expected to coincide with softer demand in 2023, allowing for only a moderate rise in vacancy. An economic slowdown could further soften market conditions, although market vacancy rates are exceptionally low and may only rise moderately, offsetting negative cyclical impact on rent growth. Indeed, rents rose (3%) in Q4 2022,i even as the macro landscape became more uncertain.

EXHIBIT 8 - TMS vs. NER Growth, country level Europe

EXHIBIT 9 - EFFECTIVE MARKET RATE, EUROPE i

EXHIBIT 10 - TOP 10 RENT GROWTH MARKETS, EUROPE i

- Prague

- South Netherlands

- Greater London

- Warsaw

- Berlin

- Hamburg

- Midlands

- Greater Silesia

- Rotterdam

- Munich

China

Rent growth in China slowed throughout 2022, ending with 0.2% growth year-over-year, a deceleration from historical growth of around 4-5% annually.i While deliveries stayed near a record high of 103 MSF, strict COVID-19 lockdowns beginning in Q2 constrained demand, causing the national vacancy rate to drift upward to 19% from 16% at the end of 2021.v Rent growth was higher in city clusters with land scarcity, and customers competed for limited available space. In city agglomerate centers, where vacancies ended the year around 10%, rents grew at 1.6%, whereas non-agglomerate metropolises with more than 20% vacancy recorded a decline of -2.5%.

Japan

Rents grew a modest but historically consistent 1.4% year-over-year, slightly higher than the previous year’s growth just under 1%i. High inflation (by Japan’s standards) has not flowed to rental pricing and remains low by global standards as the rate of inflation, excluding food and gas, remained around the 2% range.vi Deliveries climbed 26% to 52 MSF in 2022, exceeding record demand of 44 MSF.vii Vacancy rose to 3.9% but remained below the previous peak of 6% in 2017.iii Elevated development in regional markets, especially Nagoya, lifted vacancy rates and kept rent growth lower than Tokyo and Osaka.

Mexico

Rents grew 16% across the top six Mexican markets in 2022. Juarez and Monterrey led with 25% year-over-year.i Nearshoring investments are lifting demand with new supply slow to come online. Customers compete for few available spaces with vacancies on the border markets under 1%.iii This dynamic is likely to continue because land sites with sufficient energy availability in the border markets are scarce. Meanwhile, e-commerce continues to grow, underpinning demand in consumer-oriented markets, such as Mexico City, Guadalajara and Monterrey. The estimated e-commerce penetration rate of retail sales should reach 11-12% in 2022, up from 10% in 2021.viii

Brazil

Rents grew 10.8% across Sao Paulo and Rio de Janeiro, down from 13.2% in 2021iii on a nominal basis, but up on an inflation-adjusted basis (2.8% in 2021 versus 4.5% in 2022).i The vacancy rate remained stable in the low teens (11%-13%) throughout the year due to counterbalancing factors. On one hand, tight monetary conditions reduced new developments significantly. On the other, customers signed smaller leases on average versus one year ago (50,000 versus 100,000 SF). Overall, flight to quality is the key driver for e-commerce and third-party logistics customers who are focused on locations close to end consumers and best-in-class quality buildings.

Endnotes

[i] Prologis Research tracks rental rates on a net effective basis. Net effective rents are headline rates adjusted for free rent. By doing so, we can capture changes in true economic lease terms. Real rates are adjusted by end of year inflation. Data as of Q4 2022.

[ii] U.S. data from CBRE, C&W, JLL, Colliers, CBRE-EA, Prologis Research; Europe data from CBRE, C&W, JLL, Colliers, Fraunhofer, Gerald Eve, Prologis Research. As of Q4 2022.

[iii] Source: Prologis Research. As of Q4 2022.

[iv] Source: Prologis Research, Federal Reserve Economic Data, Eurostat. Note: 24-month period as of Oct ‘22. Price index based on basket of commodities needed to develop a logistics warehouse. Basket weights are 47.5% for concrete, 27.1% for structural steel, 17% for roofing and paving, and 8.5% for fire protection pipe.

[v] Source: JLL, Prologis Research.

[vi] Source: Ministry of Internal Affairs and Communications.

[vii] Source: CBRE, Prologis Research.

[viii] Source: Morgan Stanley, Euromonitor