What’s Next for the European Logistics Real Estate Market?

The European logistics real estate market is in expansion. Demand levels are higher than ever; vacancy levels are at a record low; rent growth is materializing; and investor interest is ratcheting up to new heights. Growth can be attributed to a number of structural tailwinds, such as urbanization and e-commerce. On top of that, economic uplift is fueling demand.

Within Prologis, there is strong portfolio expansion, too—roughly 2.5 million square meters over the past three years to meet customer and market needs. Overall, the market is in a great shape. Those who look ahead ask: Where is the European market headed next?

“It’s misleading to speak about the European logistics real estate market,” says Dirk Sosef, vice president research and strategy, Prologis Europe. He explains, “Take vacancy rates. The market average in Europe is 5.2 percent, but in Munich it’s 0.4 percent, one of the lowest in the world, while in Paris it’s steadily declined quarter on quarter but is still around 8 percent. The same scattered picture applies to rent trends. Some markets have seen significant growth, while others still have depressed rents. You can look at top-line results for Europe, but to understand the overall expansion you need to scratch beneath the surface.”

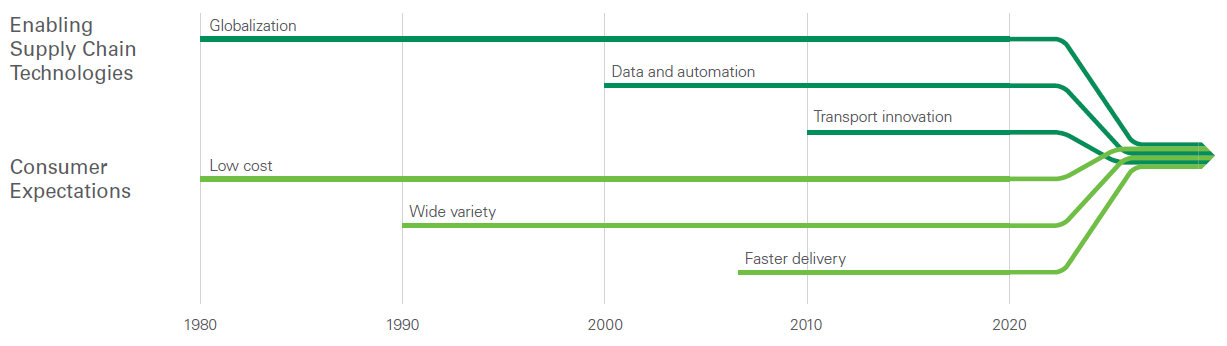

So how do we do that? First, we need to consider which external forces impact supply chains and the role of logistics real estate. Generally, two fundamental forces affect supply chains: technology and consumer expectations.

Source: Prologis Research

We learned from a recent Prologis white paper series about supply chain trends that the biggest impact on supply chains comes from the consumption end. This is where logistics operators invest and expand most.

But what happens to the logistics real estate market as a result? First, the market responds to more logistics activity closer to consumers, which is met with the expansion of real estate closer to consumption centers. This underlines the importance of building and maintaining a land bank. Land suitable for logistics real estate is becoming scarcer and harder to obtain. From the perspective of a long-term investor, this focus on the consumption end is a positive sector evolution because we can expect diverse demand at any point in the economic cycle (even in characteristically tight markets), which is good news for long-term value growth.

Secondly, a warehouse is not a box anymore. Diverse consumer demand has led to wide-ranging operational requirements for logistics properties. A Last Touch® facility in a large urban area such as London fulfils a different function than a European distribution center in the southern part of the Netherlands. Sustainability is important for tenants and other stakeholders alike, which means that big steps are taken in terms of energy efficiency and renewable energy generation. Furthermore, labor scarcity leads to an extra focus on employee well-being, as seen in a recent pilot project in Tilburg, Netherlands.

Plants at the WELL Building Standard™ pilot warehouse

These trends have an impact on market performance and can shed light on which markets have high potential for investors. For example, if we know that supply chains are shifting toward consumers, it makes sense to review the areas in which consumer spending is highest. We expect these areas will have greater demand for logistics real estate.

Similarly, we know that the implementation of cutting-edge technology in a facility usually requires a certain scale to be profitable. Such operations are often located in logistics corridors and characterized by high-quality infrastructure, which provides access to large catchment areas and key economic networks.

The European logistics real estate market is diverse and changing. Beneath the surface, there are structural differences between markets that interact with supply chain trends, such as changing technology and consumer expectations. To understand these differences and the impact they have on the DNA of logistics real estate markets, we developed a classification comprising four distinct market types. We look forward to discussing these classifications in an upcoming article. [sentence to change after publication]

Want to learn more? Please join us at EXPO REAL, Europe's largest real estate and investment trade fair. Sosef will host a panel discussion titled “Investment Opportunities in Europe—Explore the Best Opportunities in a Diverse Investment Landscape.” Learn more and register here.