From facilitating jobs to boosting the tax base: logistics real estate will have a growing impact on the changing global economy and the future flow of goods.

Today, logistics real estate delivers goods into the hands of time-conscious consumers faster than ever. A critical component of the world’s supply chain, Prologis sees many of those goods flow through our distribution centers each year. These products represent the diverse scope of what makes modern life possible: food and beverage, household necessities, apparel, autos, electronics, building and transportation supplies, industrial equipment, and medical supplies and pharmaceuticals.

Logistics real estate is much more than the distribution of goods. Prologis’ impact on the global economy and job growth is tangible and, perhaps, unexpected.

Our economic impact analysis examines the overall contribution of our business and our customers’ activity with us on the global economy. As the global leader in logistics real estate, we know our business has big global economic impact. But just how big, exactly? We partnered with Oxford Economics on an intensive study to aggregate and analyze the data and determine the following:

- The economic value of goods flowing through our facilities

- The global economic impact of our business

- The number of jobs under our roofs

- Prologis’ direct impact on jobs around the world

- Our customers’ contribution to the global tax base1

Here is what we discovered:

1. The economic value of goods flowing through Prologis facilities is unparalleled in the industry.

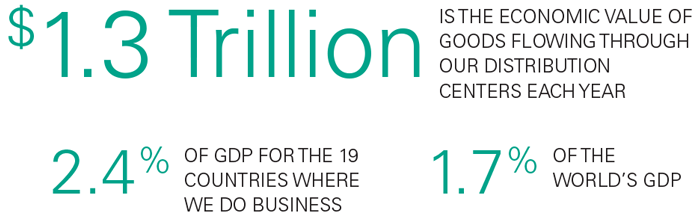

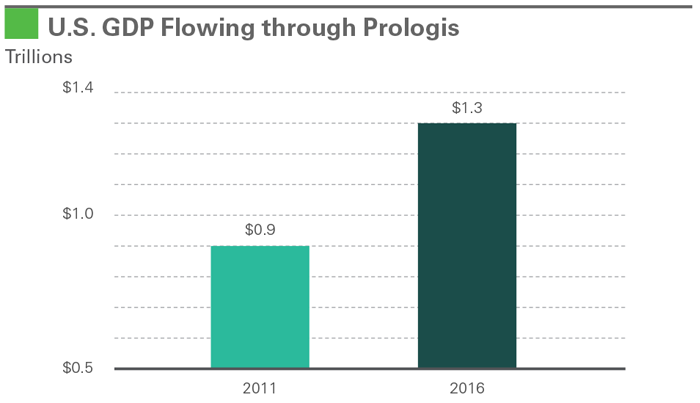

The value of goods flowing through our buildings annually is nearly $1.3 trillion. Considering that the GDP of the 19 countries in which we operate is $53.2 trillion, the share of goods flowing through our facilities is 2.4 percent of their total economic output. More broadly, the flow of goods through Prologis warehouses amounts to 1.7 percent of global GDP of $75.3 trillion.

At the end of 2016, Prologis owned and operated 627 million square feet across 3,147 buildings on four continents—more than all the modern logistics stock in China, Japan, Singapore and Korea combined. Prologis and Oxford Economics conservatively estimate that throughput equates to $2 million per thousand square feet.2

2. Logistics clusters bring significant indirect economic benefit to local municipalities and the countries in which they are located.

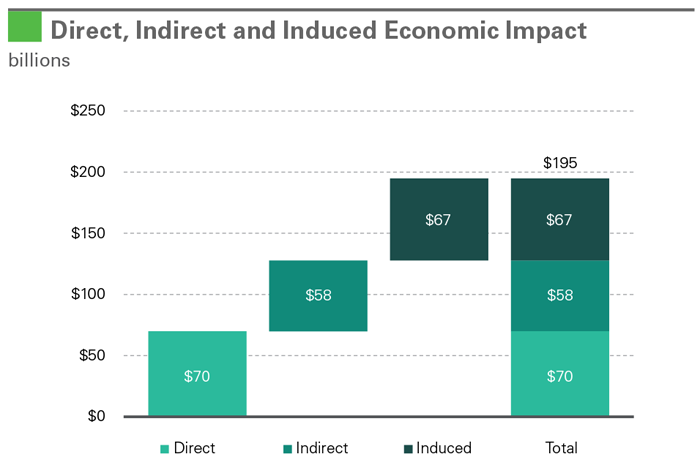

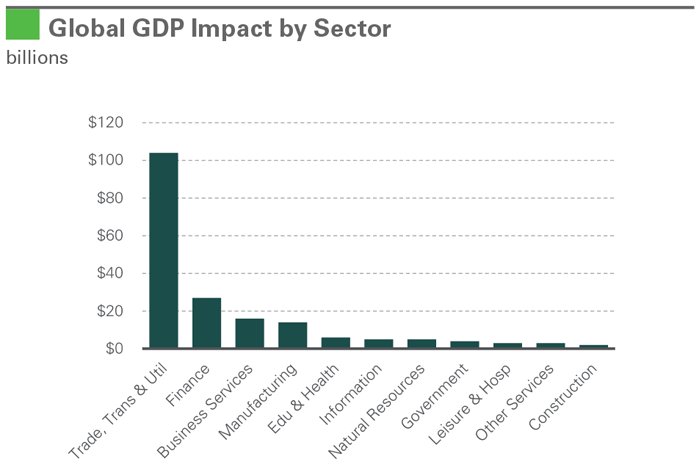

In total, the GDP economic impact generated by Prologis and our customers is nearly $200 billion, which translates into more than $500 million per day of economic value around the world. Total economic value includes $70 billion of direct impact, $58 billion of indirect impact and $67 billion of induced impact.³

3. Logistics real estate helps to support job growth in communities around the world.

More than 800,000 people work under Prologis roofs—more than the global workforces of Coca-Cola, McDonald’s and Starbucks combined. In the U.S. alone, nearly 500,000 people work in our buildings, more than the combined employee bases of General Electric and Boeing.

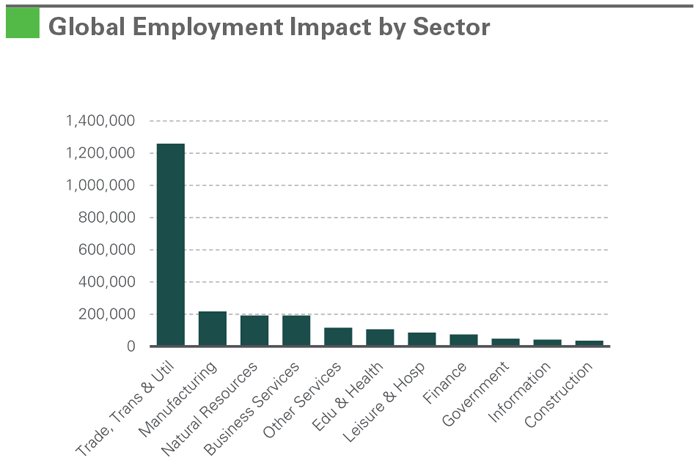

4. Prologis’ global employment impact is significant.

Our employment impact analysis examines the overall contribution of our business and our customers’ activity with us on global jobs. In aggregate, it is 2.4 million jobs.⁴This includes direct (816,000 jobs), indirect (664,000 jobs) and induced impact (892,000 jobs).⁵ In the U.S., the figure is 1.0 million.

To put it in context: If our employment impact were a city, Prologis would be the fourth-largest city in the U.S.— bigger than Houston, Philadelphia or Phoenix.

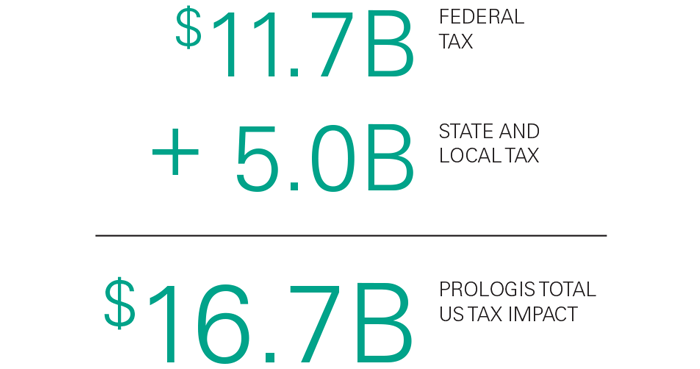

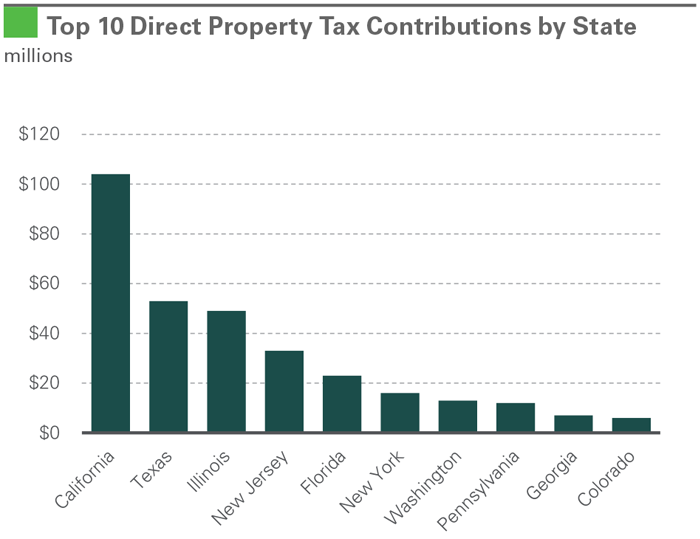

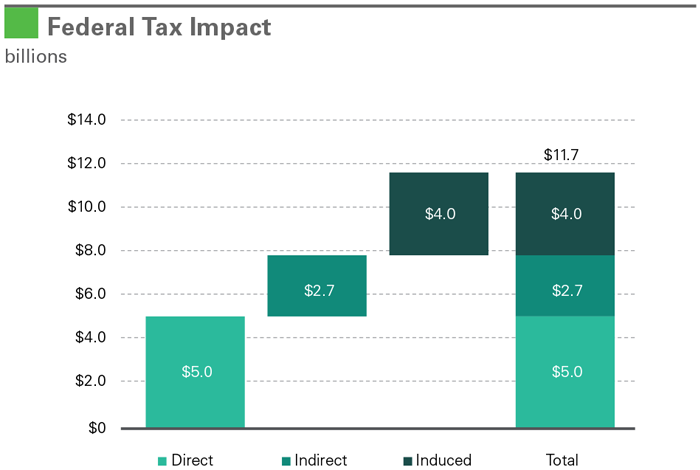

5. The economic impact of logistics real estate supports local and federal tax bases.

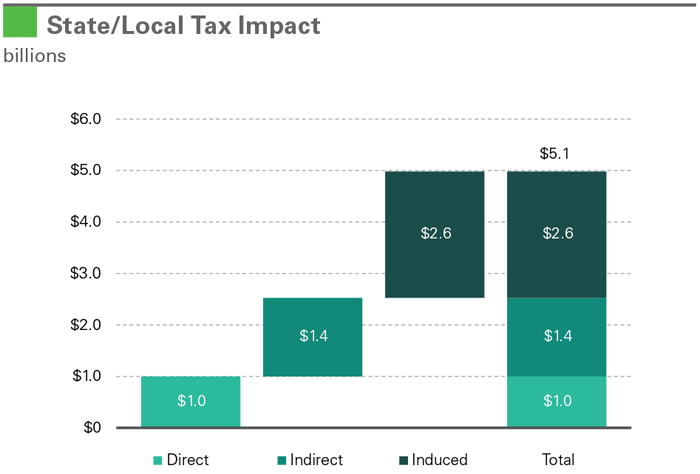

The overall U.S. tax contribution of Prologis and our customers’ activity with us is $16.7 billion. Using IMPLAN software, Oxford Economics found that the activity under Prologis’ roofs leads to $11.7 billion in federal taxes and $5.0 billion in state and local taxes annually. This includes taxes generated from the direct ($5.0 billion federal, $1.0 billion state and local), indirect ($2.7 billion federal, $1.4 billion state and local) and induced impacts ($4.0 billion federal, $2.6 billion state and local).⁶

Conclusion: Prologis has a pronounced—and much greater than expected—effect on the global economy.

As we envision the future flow of goods, we anticipate that Prologis’ role will expand in lockstep with consumers’ growing demand for ever-faster delivery of goods, and the corresponding response by our customers and their supply chains to meet those demands.

Methodology

Oxford Economics used industry-leading best practices to conduct the research and built an economic impact model based on the World Input-Output Database to estimate the global economic values and job impacts.

Inputs to the Input-Output model were constructed from the square footage data in the Q1 2017 Prologis Supplemental Information document. From here, we assumed 69 square meters of warehouse space per employee, based on previous Prologis research. These on-site employment numbers were translated into output figures (i.e. dollars of economic output) using national employment to output ratios from the World Input- Output Database social accounts. These values were assigned to the warehousing and transportation sector and used as the inputs to the WIOD model.

We refer to three types of impacts:

- The direct impact is the employment/value-add of Prologis and its customers. In this case, this is the activity taking place in warehouses themselves.

- The indirect impact is the economic activity in the Prologis supply chain and the supply chain of their customers.

- The induced impact is the activity generated by the spending of workers’ wages, which are associated with the three types of impacts.

Note: absent any leakages, the direct plus indirect GDP impact of $1 of final goods spending is exactly $1, distributed among the direct and supply chain industries.

Footnotes

1. To support this research, Oxford Economics built an economic impact model based on the World Input-Output Database to estimate global economic values and the effects on jobs. In the U.S., Oxford Economics sourced IMPLAN to cross-check these results and provide information about additional tax impacts.

2. In 2012, the total flow of intermediate and final goods in the U.S. (excluding pipelines) was $13.3 trillion (source: Commodity Flow Survey). Inflating to 2017, this equates to $14.3 trillion, or $15.9 trillion with growth proportional to GDP. Total institutional-grade logistics space in the U.S. is 4.5 billion square feet (source: Prologis Research based on Costar data). This yields $3.5 million per thousand square feet. However, since many goods are not stored in (institutional-grade) logistics facilities/distribution centers, Oxford Economics deflates by roughly 40 percent, resulting in $2.1 million per thousand square feet.

3. For the economic impact of our business, we measured across three channels:

-

The direct impact is the economic activity taking place in our warehouses themselves.

-

The indirect impact is the economic activity across the supply chain due to the business taking place in our facilities.

-

The induced impact is the economic activity supported by people working under our roofs spending their wages.

4. For the operational impact model, we consistently assume 743 square feet/69 square meters of warehouse space per worker, based on detailed Prologis research conducted in the UK (source: Prologis Research “Distribution Warehouses Deliver More Jobs”). While the same employment density is used, this corresponds to various levels of economic activity at Prologis buildings, based on local labor productivity data. The indirect and induced impacts also vary, according to the model.

5. For the jobs impact of our business, we measured across three channels:

The indirect employment impact is those working across the supply chain due to the business taking place in our facilities.

The induced employment impact is those working to produce the goods and services purchased out of the wages of people working in the warehouses, or in the warehouses’ supply chain.

-

The direct employment impact is those working in warehouses themselves.

-

The indirect employment impact is those working across the supply chain due to the business taking place in our facilities.

-

The induced employment impact is those working to produce the goods and services purchased out of the wages of people working in the warehouses, or in the warehouses’ supply chain.

6. For the tax impact of our business, we measured across three channels:

-

The direct tax impact is the taxes generated by the economic activity taking place in warehouses themselves.

-

The indirect tax impact is the taxes generated by the economic activity in the supply chain due to business taking place in our facilities.

-

The induced tax impact is the taxes generated by the economic activity supported by the spending out of the wages of people working in the warehouses, or in the warehouses’ supply chain.

Forward-Looking Statements

This material should not be construed as an offer to sell or the solicitation of an offer to buy any security. We are not soliciting any action based on this material. It is for the general information of customers of Prologis.

This report is based, in part, on public information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied on as such. No representation is given with respect to the accuracy or completeness of the information herein. Opinions expressed are our current opinions as of the date appearing on this report only. Prologis disclaims any and all liability relating to this report, including, without limitation, any express or implied representations or warranties for statements or errors contained in, or omissions from, this report.

Any estimates, projections or predictions given in this report are intended to be forward-looking statements. Although we believe that the expectations in such forward-looking statements are reasonable, we can give no assurance that any forward-looking statements will prove to be correct. Such estimates are subject to actual known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date of this report. We expressly disclaim any obligation or undertaking to update or revise any forwardlooking statement contained herein to reflect any change in our expectations or any change in circumstances upon which such statement is based.

No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Prologis.

About Prologis Research

Prologis’ Research department studies fundamental and investment trends and Prologis’ customers’ needs to assist in identifying opportunities and avoiding risk across four continents. The team contributes to investment decisions and long-term strategic initiatives, in addition to publishing white papers and other research reports. Prologis publishes research on the market dynamics impacting Prologis’ customers’ businesses, including global supply chain issues and developments in the logistics and real estate industries. Prologis’ dedicated research team works collaboratively with all company departments to help guide Prologis’ market entry, expansion, acquisition and development strategies.

About Prologis

Prologis, Inc. is the global leader in logistics real estate with a focus on high-barrier, high-growth markets. As of June 30, 2017, the company owned or had investments in, on a wholly owned basis or through co-investment ventures, properties and development projects expected to total approximately 684 million square feet (63.6 million square meters) in 19 countries. Prologis leases modern distribution facilities to a diverse base of approximately 5,200 customers across two major categories: business-to-business and retail/online fulfillment.

About Oxford Economics

Oxford Economics was founded in 1981 and is one of the world’s foremost independent global advisory firms, providing reports, forecasts and analytical tools on 200 countries, 100 industrial sectors and over 4,000 locations. The firm’s best-of-class global economic and industry models and analytical tools give it an unparalleled ability to forecast external market trends and assess economic, social and business impacts.

Oxford Economics is a key adviser to corporate, financial and government decision-makers and thought leaders. The firm’s worldwide client base now comprises over 1,200 international organizations, including leading multinational companies and financial institutions, key government bodies, trade associations, top universities, consultancies and think tanks.

Headquartered in Oxford, England, with regional centers in London, New York, and Singapore, Oxford Economics has more than 20 offices across the globe. It employs over 300 full-time staff, including 200 professional economists, industry experts and business editors—one of the largest teams of macroeconomists and thought leadership specialists. The firm’s global team is highly skilled in a full range of research techniques and thought leadership capabilities, from econometric modelling, scenario framing, and economic impact analysis to market surveys, case studies, expert panels and web analytics. Underpinning its in-house expertise is a contributor network of over 500 economists, analysts and journalists around the world.